Hardly likely. Propensity to gamble in Asian markets is legendary, and as the saying goes… where there’s a will there’s a way.

But the question is a valid one, raised in light of the results recently reported by one of the world’s largest online casino (including live games) B2B suppliers – Playtech.

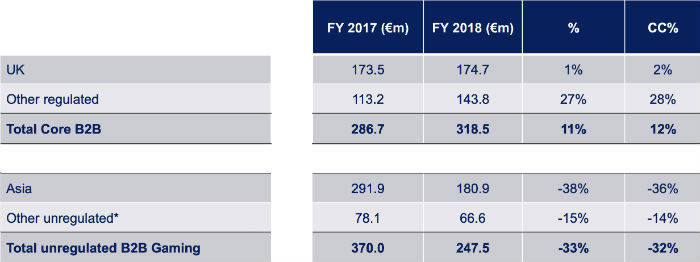

In their 2018 year end results presentation, buried deep among a myriad of slides covering all facets of their extensive operation, was this one, detailing the change in Asian source B2B revenues.

A year on year fall of 38%, equating to over EUR 100 million, is significant.

This figure applies to all Playtech product segments…sport betting, casino, poker and bingo. We don’t know what portion of this drop is attributable to live casino games which make up a sub-section of the casino segment. But it is likely that there was a decline in live games as well.

Whether and to what extent this decline has been experience by the broader industry is also not known. Playtech is a publicly listed company that must disclose its results. Most live game platform providers operating the Asian market have lesser reporting obligations. It’s a pretty opaque industry as the best of times.

What we do know is that more and more markets across Asia are making concerted efforts to ban online gambling, as Singapore did in 2015. And while large brand name operators and their platform providers are usually happy to accept players in grey markets, they will exit if those markets turn black.

Of course, not all operators and providers will exit these markets. And going back to the old, ‘where there’s a will there’s a way‘ thing, it’s likely players are still finding live tables to play. Just tables that are not quite as good. In many respects.

Leave a comment

You must be logged in to post a comment.